investing in Morocco, After a decline during the global recession, FDI flows to Morocco increased in 2014 and 2015, exceeding USD 3 billion. After falling by 29% to USD 2.32 billion, FDI inflows picked up in 2017 to USD 2.66 billion (15.4% y-o-y increase) (UNCTAD World Investment Report 2018). According to preliminary data from the Moroccan Foreign Exchange Office, FDI inflows rose by 25.9% year-on-year to MAD 32.8 billion in 2018 (USD 3.44 billion). In terms of stocks, France is by far the largest investor in the country, followed by United Arab Emirates, Spain and United States. Manufacturing has the highest share of FDI stocks, followed by real estate, telecommunications, tourism and energy.

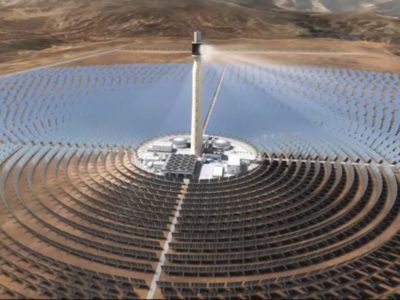

Morocco launched a vast project of economic modernization program (Industrial Acceleration Plan 2014-2020) to attract more FDI. Casablanca in particular aims to become an international financial centre. The construction of Ouarzazate Solar Power Station, expected to become the largest solar plant in the world with a total capacity of 510MW upon completion, is one of the largest infrastructure investments, not only in Morocco but in the whole of Africa. Quantum Global ranked Morocco as the most attractive country for foreign investment in Africa in its Africa Investment Index 2018. Furthermore, Morocco is ranked 60th out of 190 economies by the World Bank in its Doing Business 2019 report, gaining nine spots compared to 2018, and up by 34 spots from 2012.

| Foreign Direct Investment | 2015 | 2016 | 2017 |

|---|---|---|---|

| FDI Inward Flow (million USD) | 3,255 | 2,157 | 2,651 |

| FDI Stock (million USD) | 49,671 | 54,784 | 62,664 |

| Number of Greenfield Investments*** | 74 | 80 | 91 |

| FDI Inwards (in % of GFCF****) | 11.3 | 7.6 | n/a |

| FDI Stock (in % of GDP) | 49.4 | 52.9 | n/a |

Source: UNCTAD, Latest available data.

Note: * The UNCTAD Inward FDI Performance Index is Based on a Ratio of the Country’s Share in Global FDI Inflows and its Share in Global GDP. ** The UNCTAD Inward FDI Potential Index is Based on 12 Economic and Structural Variables Such as GDP, Foreign Trade, FDI, Infrastructures, Energy Use, R&D, Education, Country Risk. *** Green Field Investments Are a Form of Foreign Direct Investment Where a Parent Company Starts a New Venture in a Foreign Country By Constructing New Operational Facilities From the Ground Up. **** Gross Fixed Capital Formation (GFCF) Measures the Value of Additions to Fixed Assets Purchased By Business, Government and Households Less Disposals of Fixed Assets Sold Off or Scrapped.

FDI INFLOWS BY COUNTRY AND INDUSTRY

| Main Investing Countries | 2018, in % (preliminary data) |

|---|---|

| France | 19.3 |

| United Arab Emirates | 12.4 |

| Spain | 9.1 |

| Denmark | 6.0 |

| Japan | 5.8 |

| Luxembourg | 5.6 |

| United States | 5.3 |

| United Kingdom | 4.8 |

| Qatar | 4.3 |

| Main Invested Sectors | 2018, in % (preliminary data) |

|---|---|

| Real estate | 20.2 |

| Manufacturing | 19.7 |

| Energy and mining | 14.4 |

| Trade and reparation of vehicles | 11.7 |

| Tourism | 8.7 |

| Transportation | 8.0 |

Source: Foreign Exchange Office of the Ministry of Finance – Latest available data. Form of Company Preferred By Foreign InvestorsS.A(public ltd. company), S.A.R.L (private ltd. companyForm of Establishment Preferred By Foreign InvestorsSubsidiaryMain Foreign CompaniesTelefonica, the Spanish telecommunications giant shows its presence through the Méditel mobile operator and call centers Atento. Dell has just completed its largest center of Europe-Africa-Middle East area.

France has nearly 500 subsidiary companies in Morocco which employ on the whole more than 65,000 people. Among the principal subsidiary companies of foreign companies based in Morocco, one can quote Total, Renault, Holcim but also STMicroelectronics (en anglais), Sanofi-Aventis and Nestlé.Sources of StatisticsForeign exchange office

What to consider if you invest in Morocco

Strong Points for investing in Morocco, are:

- A legal framework and assistance measures very favourable to investors

- Relatively low labour cost

- A strategic location, between Europe and sub Saharan Africa

- A young and relatively well-trained population

- Political stability encouraged by the popularity of the King, Mohammed VI

Weak Points for investing in Morocco:

The main obstacles to the development of FDI in Morocco are:

- A relatively small internal market

- A country still highly dependent on agriculture and therefore vulnerable to natural disasters and the price of hydrocarbons

- Administrative burdens slowing down, among other things, the start of business activities

- Significant social disparities by region (rural vs. urban) and a high poverty rate

- High unemployment rate and low productivity

- A lack of transparency in public procurement

Government Measures to Motivate or Restrict FDIThe government adopted the “Investment Charter” in 1995. This charter mainly provides company exemptions for VAT and for corporate tax for 5 years under certain conditions.

In the industrial sector, the Emergence Plan creates infrastructure which offer turnkey premises.

In the case of offshoring facilities, the government has offered telecommunications costs set at 35% below the market price and training grants of up to US$ 7,000 for each Moroccan employee during the first three years of employment.

A new version of the investment incentive regime is currently undergoing a governmental review.

Major fiscal consolidation efforts were initiated in 2013 and led to a gradual stabilisation of the fiscal deficit. In 2017, spending, although above revenue, remained under control despite a period when the country was out of government (November 2016 – April 2017). These efforts have been greeted with favourable response from the business community and from potential investors.

Protection of Foreign Investment in Morocco:

Bilateral Investment Conventions Signed By MoroccoMorocco has concluded agreements with 51 countries including France, Spain, Egypt, Italy, Lebanon, Libya, Portugal, Tunisia and Turkey for guarantee of overseas investments against every risk of nationalization and compulsory purchase. Several of these agreements can be downloaded on the web site of the UNCTAD. Those define the framework of protection of overseas investments for each signatory country.

Besides, the Association Agreement between the EU and Morocco, effective in March 2000, envisages also, with article 50: “establishment of a legal framework supporting investment, if necessary, by the conclusion of agreements of protection of investments and agreements intended to avoid double taxation between Morocco and the Member States”.International Controversies Registered By UNCTAD3 cases have been registered in the construction sector (construction of highways and hotels).Organizations Offering Their Assistance in Case of DisagreementICSID , International Center for settlement of Investment Disputes

ICCWBO , International court of arbitration, International chamber of commerce

Member of the Multilateral Investment Guarantee AgencyYes

Country Comparison For the Protection of Investors

| Morocco | Middle East & North Africa | United States | Germany | |

|---|---|---|---|---|

| Index of Transaction Transparency* | 9.0 | 6.0 | 7.0 | 5.0 |

| Index of Manager’s Responsibility** | 2.0 | 5.0 | 9.0 | 5.0 |

| Index of Shareholders’ Power*** | 5.0 | 4.0 | 4.0 | 8.0 |

| Index of Investor Protection**** | 5.3 | 4.5 | 6.5 | 6.0 |

Source: Doing Business – Latest available data.

Note: *The Greater the Index, the More Transparent the Conditions of Transactions. **The Greater the Index, the More the Manager is Personally Responsible. *** The Greater the Index, the Easier it Will Be For Shareholders to Take Legal Action. **** The Greater the Index, the Higher the Level of Investor Protection.

Procedures Relative to Foreign Investment

Freedom of EstablishmentGuaranteed except for the agricultural sectorAcquisition of HoldingsMajority acquisition of interest in an existing or forming Moroccan company, is authorized by way capital subscription or acquisition of already issued securities.Obligation to DeclareInvestment system in Morocco is very open as investors do not have to obtain prior approval: they simply have to send the Foreign Exchange Office a report in the six months following the completion of the operation. Competent Organisation For the DeclarationForeign exchange office

Requests For Specific AuthorisationsThe financial sector has specific regulations that of hydrocarbons as well as for free zones.

Learn more about Foreign Investment in Morocco on Globaltrade.net, the Directory for International Trade Service Providers.

Office Real Estate and Land Ownership

Possible Temporary SolutionsThere are many business domiciliation companies, in particular Sodrein or still Le Domicile d’Affaires offering a range of services to all.The Possibility of Buying Land and Industrial and Commercial BuildingsGuaranteed except for the agricultural sectorsRisk of ExpropriationWeak. Investments are guaranteed by the Investment Charter.

Investment Aid

Forms of AidGenerally contributions to finance reception infrastructures, as also in acquisition of land and construction of professional buildings.Privileged DomainsEither loans or assistance to finance infrastructures.Privileged Geographical ZonesNew Information and Communication Technologies (NITC)

Exporting industries, in particular aeronautics and automobile

TourismFree ZonesThere are industrial parks (Bouskoura, Meknès, etc.), technoparks (Casa Technopark) and free zones (that of Tangier particularly enjoying tax and special customs benefits. There is also an offshore banking law covering Tangier.Organizations Which FinanceThe Investments Commission, the Hassan II Funds for Economic and Social development and Funds of Promotion of Investments managed by the Department of Investments.

The French Development Agency on behalf of its subsidiary company Proparco.

Investment Opportunities

The Key Sectors of the National EconomyTextile-clothing, tourism.High Potential SectorsCall centers, high-technology, agriculturePrivatization ProgrammesSince the last few years, Morocco has launched an ambitious program of privatisation in many sectors of the economy. The largest privatisations were carried out in the sectors of mobile telephony, finance, tobacco stores and water supply.

In 2008, privatisations related to the food processing sector (seeds and salts in particular) as well as that of construction materials and textiles predominated. In 2009 a number of firms, including the national port operator (Marsa Maroc), were placed on the short list of companies to be privatised in the future.

A partial privatisation of the Moroccan office of phosphates as well as Royal Air Maroc is expected.Tenders, Projects and Public Procurement Tenders Info, Tenders in Morocco.

HERE IS SOME Sectors Where Investment Opportunities Are Fewer:

Monopolistic, SectorsMining sector, and Postal services

References for further information:

- Investment Aid Agency: Department of Investments & French Agency of Development

- Other Useful Resources : Economic Developments and Prospects in Morocco – African Economic Outlook

- Doing Business Guides: ANIMA Investment Network

Comments