Nowadays, Morocco has emerged as a regional leader in terms of outbound investment. FOREIGN INVESTMENTS IN MOROCCO are enhancing from 2020 till now, despite a decrease in investment levels in 2019.

Inflows were 515 million USD in the first quarter of 2020. It is almost likely to be more than $430 million at the same time in the year 2019.

1- Aspects and expectations of FOREIGN INVESTMENTS IN MOROCCO:

Morocco presently sees good development, despite the fact that FOREIGN INVESTMENTS IN MOROCCO inflows decreased in 2019.

- Before the outbreak, Morocco was Growing

According to the latest figures from the African continent, this country was the second-largest source of outflows.

It is solely bolstered by South Africa, as opposed to inflows, because of the country’s total of 1 billion USD. This was a 32.1 % increase over the previous year.

In the year 2019, a Russian company proposed a $2.2 trillion investment in Morocco to construct a refinery in the country’s northern region.

Foreign direct investment in Morocco increased significantly till 2019, with the outward growth reaching 66.5 billion dollars and the inward growth reaching 6.4 billion dollars at the conclusion of that period.

2- Plan for the Acceleration of Industrial Development:

The Industrial Acceleration Plan is great. It aims to increase the number of top FDI opportunities in Morocco.

The main goals are to generate 500,000 employments. It is the target of the nation that 50% of them will come from the FOREIGN INVESTMENTS IN MOROCCO. Having the significantly enhance the country’s transportation infrastructure is also vital.

Because of the economic ties that have been formed throughout colonial history, French businesses were the largest participants in foreign direct investment (FDI).

Indeed, between the era of 2007 and 2017, France offered the largest number of FOREIGN INVESTMENTS IN MOROCCO providers.

In the year 2018, this pattern was shattered. When Ireland invested $1.06 billion in North Africa, France invested 880 million USD. Also, the sector of Morocco insurance was the biggest recipient of FDI in 2018.

3- Known as a Gateway of Africa:

After searching, we find that this nation is the fourth largest FDI in Africa. You can observe 2.7 billion USD in the year 2017 and 3.6 billion USD in the next year, so it is rising significantly.

Following Morocco’s admission to the African Union and the opening of the CFTA, the country has maintained its position as a key gateway for foreign investment in the continent.

Morocco has maintained its position if you check the World Bank’s Doing Business Index. It is rising to 53rd place as well when you check 2020 data. The country’s economic climate and infrastructure have both substantially improved.

4- The Investment Protection Conventions:

Seventy-one bilateral investment treaties and 60 commercial agreements have been struck between this nation and other countries.

It also has many investment agreements with the USA and many other European Union countries. The country designs them to use them in order to avoid paying taxes on double income or income.

Morocco has become the first nation in the continent of Africa to eliminate tariffs on almost 95 % of eligible products under the USFTA agreement.

Taxation on some goods will be phased out by Morocco’s government by 2030, according to plans. It helps Morocco achieve its ambition of becoming a regional financial and commercial center.

It provides the opportunity to locate services as well as export and complete products for markets in the region of the Middle East, the continent of Africa and Europe, and other places.

The FTA between the United States and this country, bilateral trade in products has almost quadrupled.

When it comes to boosting FOREIGN INVESTMENTS IN MOROCCO, both of these nations work closely together.

They will address this at high-level bilateral discussions during the Biennial Trade and Investment Forum between this country and United States. Moreover, it serves as a platform for the development of relationships between businesses.

5- Facilitation of Business Transactions:

This country has 53rd position in the World Bank’s Doing Business Edition 2020. It is a market of more than 37,400,294 people. Here, the gross domestic product of more than 124 billion U.S. dollars in 2021.

The CFTA is a major component of the 2063 Agenda. Due to this, FOREIGN INVESTMENTS IN MOROCCO are enhancing in the area.

- Zones of Acceleration in the Industrial Sector:

You can see the industrial acceleration zones here due to changes in legislation budget 2020. After the first five years of exemption, we might see a corporation tax rate of 15 % in this case.

Over a 20-year period, the rate is 8.75 % higher than the previous corporation tax rate. As a result, it is a good time to invest in Morocco.

In addition to Moroccan businesses currently operating in certain areas, international corporations operating in specific regions are subject to additional limitations.

- Free ports and the facilitation of international trade:

Several open spaces are protected by the state. Companies will benefit from reduced tax rates in return for committing to exporting at least 85 % of their total output volume.

In certain instances, the government provides substantial financial advantages to businesses that choose to locate industrial plants in the nation.

In addition, the government provides a VAT exemption to investors who utilize and import products from other countries. An investment project with a value of at least $20 million is also eligible for this tax deduction.

This incentive is valid for 36 months from the date of the company’s inception. This is a long-running conflict with the European Union. As a result of new budget laws, the country’s free zones are transformed into industrial acceleration zones.

Aside from that, after five years of tax exemption, the corporation tax rate increases to 15 %. Previously, companies could obtain a corporation tax rate of 8.75 % in free zones. There will be an increase in FOREIGN INVESTMENTS IN MOROCCO.

- A thriving banking industry:

Recent years have seen a considerable improvement in the banking industry. Since the liberalization of the financial sector, credit has been freely distributed.

The penetration rate of banks is about 56 %. It presents considerable investment opportunities in Morocco, particularly in the rural and less wealthy consumer groups.

In October 2018, we saw the issuance of Islamic bonds with the name of Sukuk. Approximately $930 million in funding was provided in 2019 by Islamic banks in Morocco.

In the same year, the government approved legislation enabling Takaful. It is an Islamic insurance product.

Following a rising trend that began in 2012, the nonperforming loan (NPL) credit ratio in 2017 was $6.5 billion, or 7.5 %.

When you check the IMF data, you can see the nonperforming loans were 7.7 % in July of this year.

The FOREIGN INVESTMENTS IN MOROCCO initiative will strengthen this banking strategy in Morocco.

6- Why Invest in Morocco?

So, why invest in Morocco? There are now many major initiatives and economic policies in place to improve and boost foreign investment.

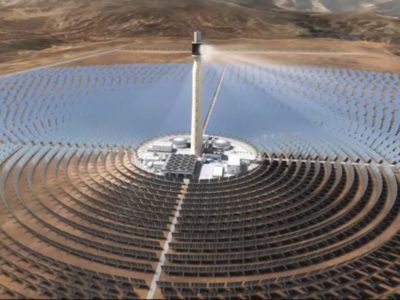

Morocco has a large potential in technology manufacturing and financial services. You can also observe growth in the traditional industrial or real estate sectors. These two sectors are in accordance with current local objectives.

They include but are not limited to Maroc Digital 2020 and the construction of Casablanca Finance City.

It is true that investment always aims for profitability. But if profitability is combined with clear and solid regulations and a secure economic environment, it is the ideal approach to attract money. A top Morocco investment promotion agency can serve you for it.

We are sure that in the years to come, there is a huge attraction of the FOREIGN INVESTMENTS IN MOROCCO.

Comments